tempe az sales tax calculator

Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. Method to calculate Tempe Camp sales tax in 2022.

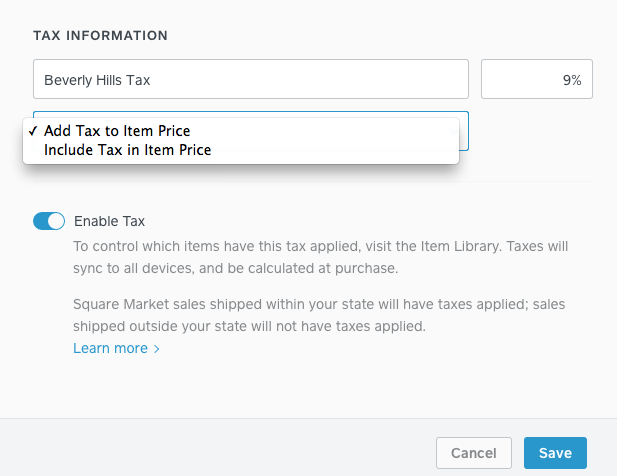

How To Collect Sales Tax Through Square Taxjar

However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License.

. The minimum is 56. The December 2020 total local sales tax rate was also 8100. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax.

Apply or Renew on the Accela Citizen AccessACA Portal. Arizona State Sales Tax. Interactive Tax Map Unlimited Use.

The County sales tax. Click The Logo Below To View The Model City Tax Code. Average Local State Sales Tax.

The current total local sales tax rate in Tempe AZ is 8100. Apply File Pay Transaction Privilege Tax TPT or sales tax at AZTaxesgov. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 6300. Subject to Transaction Privilege TaxTPT or sales tax an alternative to hotels and motels but taxed the same commonly advertised on an online marketplace for lodging.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The current total local sales tax rate in Tempe Junction AZ is 6300. The Arizona sales tax rate is currently.

Tempe Sales Tax Rates for 2022. See reviews photos directions phone numbers and more for sales tax. Arizona has a 56 statewide sales tax rate but also.

Sales tax in Tempe Arizona is currently 81. To calculate the sales tax on your vehicle find the total sales tax fee for the city. What Businesses Are Taxable And At What Tax Rate.

Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. The december 2020 total local sales tax rate was also 6300. How to Calculate Arizona Sales Tax on a Car.

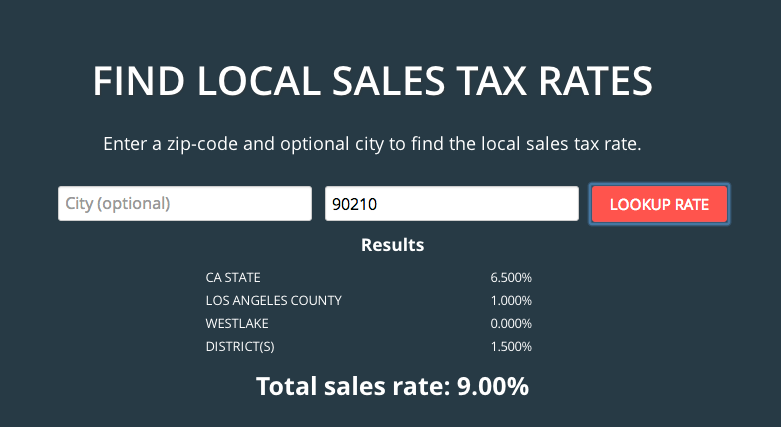

Ad Lookup Sales Tax Rates For Free. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ. Maximum Local Sales Tax.

Tempe Az Sales Tax Calculator. You can now choose the number of locations within Arizona that. Maximum Possible Sales Tax.

Arizona has a 56 statewide sales tax rate but also has 99 local tax jurisdictions including cities towns counties and special districts that. The minimum combined 2022 sales tax rate for Tempe Arizona is. Multiply the vehicle price.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180.

How To Collect Sales Tax Through Square Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Audit Guide For Businesses

Arizona Income Tax Calculator Smartasset

Tax Brackets 2019 Tax Brackets Bracket Tax

Highest Gas Tax In The U S By State 2022 Statista

Arizona Sales Tax Small Business Guide Truic

Location Based Reporting Arizona Department Of Revenue

Arizona Sales Tax Rates By City County 2022

How To Collect Sales Tax Through Square Taxjar

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price